Understanding New York State income tax (NYS income tax) is essential for residents, businesses, and anyone earning income within the state. Whether you're a first-time taxpayer or a seasoned professional, staying informed about the latest tax regulations ensures compliance and helps you optimize your financial health. NYS income tax plays a crucial role in funding essential services and programs, making it a critical component of state governance.

New York State has one of the most comprehensive tax systems in the United States, and navigating it can seem overwhelming. However, with the right knowledge and resources, you can manage your NYS income tax obligations effectively. This guide aims to simplify the process by breaking down key concepts, offering practical tips, and addressing common questions.

By the end of this article, you'll have a clear understanding of how NYS income tax works, including filing requirements, deductions, credits, and penalties. Let's dive in and explore everything you need to know about New York State income tax.

Read also:Ironmouse Age Unveiling The Life And Legacy Of A Virtual Streaming Icon

Table of Contents

- Introduction to NYS Income Tax

- Understanding Filing Status

- NYS Income Tax Rates

- Deductions and Exemptions

- Tax Credits Explained

- The Filing Process

- Penalties for Late Filing and Payment

- Amending Tax Returns

- Helpful Resources and Tools

- Conclusion and Call to Action

Introduction to NYS Income Tax

What is NYS Income Tax?

NYS income tax refers to the tax levied by the State of New York on individuals, businesses, and other entities earning income within its borders. It is a progressive tax system, meaning that the tax rate increases as taxable income increases. The revenue generated from NYS income tax funds vital services such as education, healthcare, infrastructure, and public safety.

Why is NYS Income Tax Important?

Understanding NYS income tax is crucial for several reasons. First, it ensures that you meet your legal obligations as a taxpayer. Second, proper management of your tax affairs can lead to significant savings through deductions and credits. Lastly, staying informed about tax laws helps you avoid penalties and potential legal issues.

Understanding Filing Status

Your filing status determines the tax rates and deductions you are eligible for under NYS income tax. The main filing statuses include Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er). Choosing the correct status is essential for accurate tax calculations.

Key Considerations for Filing Status

- Single: For individuals who are unmarried or legally separated at the end of the tax year.

- Married Filing Jointly: Ideal for couples who want to combine their incomes and deductions.

- Married Filing Separately: Allows spouses to file separate returns, which may be beneficial in certain situations.

- Head of Household: Available to single or unmarried taxpayers who support a qualifying dependent.

- Qualifying Widow(er): For individuals who lost their spouse and meet specific criteria.

NYS Income Tax Rates

NYS income tax operates on a progressive scale, with rates ranging from 4% to 10.9% depending on your taxable income. The tax brackets are adjusted annually for inflation, ensuring fairness and consistency. Below is a breakdown of the current NYS income tax rates:

2023 NYS Income Tax Brackets

- 4%: For taxable income up to $8,500

- 4.5%: For income between $8,501 and $11,700

- 5.25%: For income between $11,701 and $13,900

- 5.97%: For income between $13,901 and $21,800

- 6.29%: For income between $21,801 and $80,650

- 6.85%: For income between $80,651 and $215,400

- 7.82%: For income between $215,401 and $1,077,550

- 10.30%: For income exceeding $1,077,551

Deductions and Exemptions

Deductions and exemptions are essential tools for reducing your taxable income under NYS income tax. By taking advantage of these provisions, you can lower your tax liability and increase your take-home pay.

Standard Deduction vs. Itemized Deductions

Taxpayers can choose between the standard deduction or itemized deductions. The standard deduction is a fixed amount based on your filing status, while itemized deductions allow you to list specific expenses such as mortgage interest, charitable contributions, and medical expenses.

Read also:Rocky 1 Cast Exploring The Iconic Characters And Their Legacy

Personal Exemptions

Under NYS income tax, you can claim personal exemptions for yourself, your spouse, and dependents. The exemption amount is adjusted annually for inflation and can significantly reduce your taxable income.

Tax Credits Explained

Tax credits provide direct reductions in the amount of tax you owe, making them more valuable than deductions. NYS offers various credits to help taxpayers offset their tax burden.

Common NYS Tax Credits

- Child Tax Credit: Available for taxpayers with qualifying children under a certain age.

- Earned Income Tax Credit (EITC): Designed to assist low- and moderate-income individuals and families.

- Homeowners' Property Tax Credit: Helps reduce property tax burdens for eligible homeowners.

- Senior Citizens' Exemption: Provides tax relief for senior citizens with limited income.

The Filing Process

Filing your NYS income tax return involves several steps, from gathering necessary documents to submitting your completed return. Ensuring accuracy and timeliness is crucial to avoid penalties and delays.

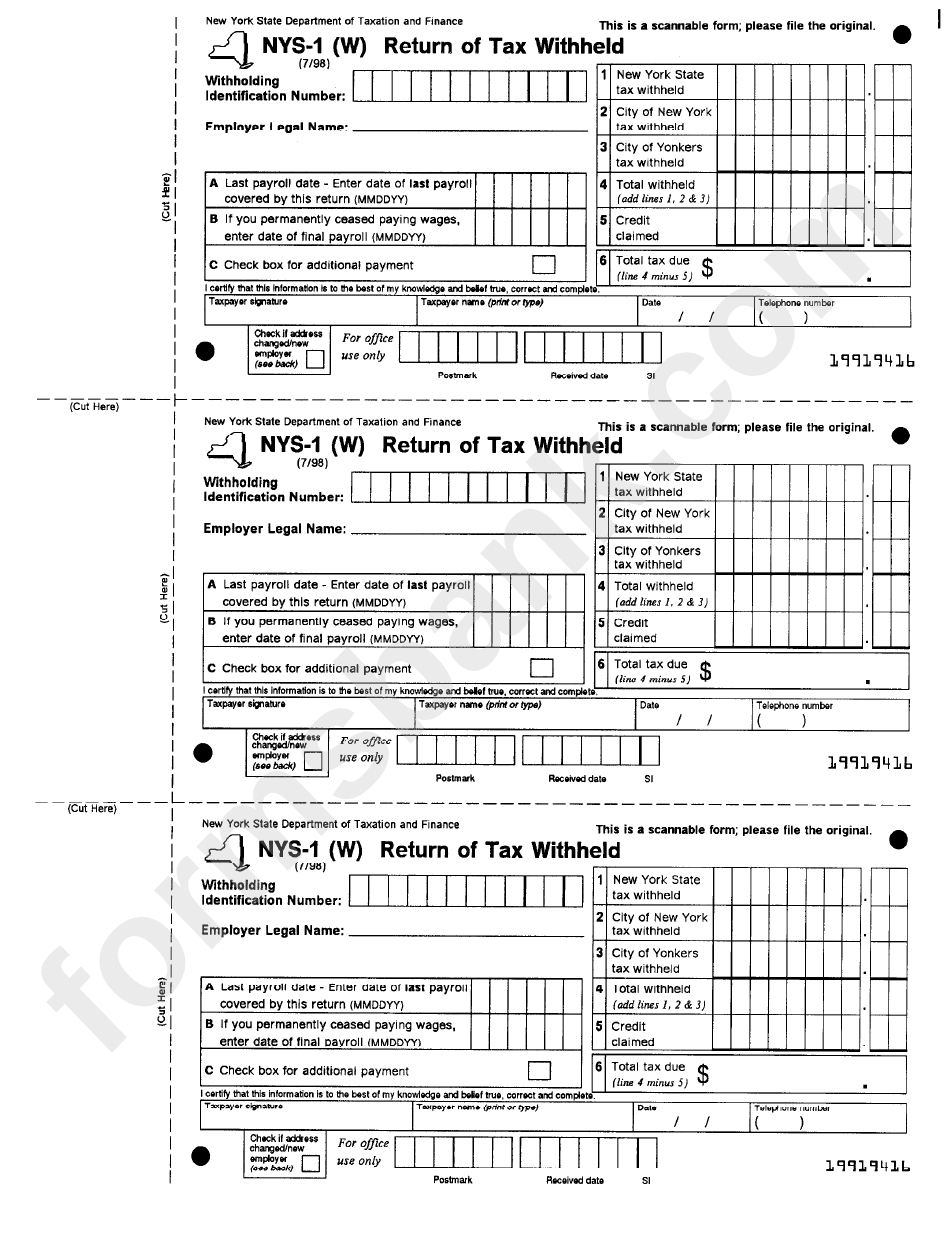

Gathering Required Documents

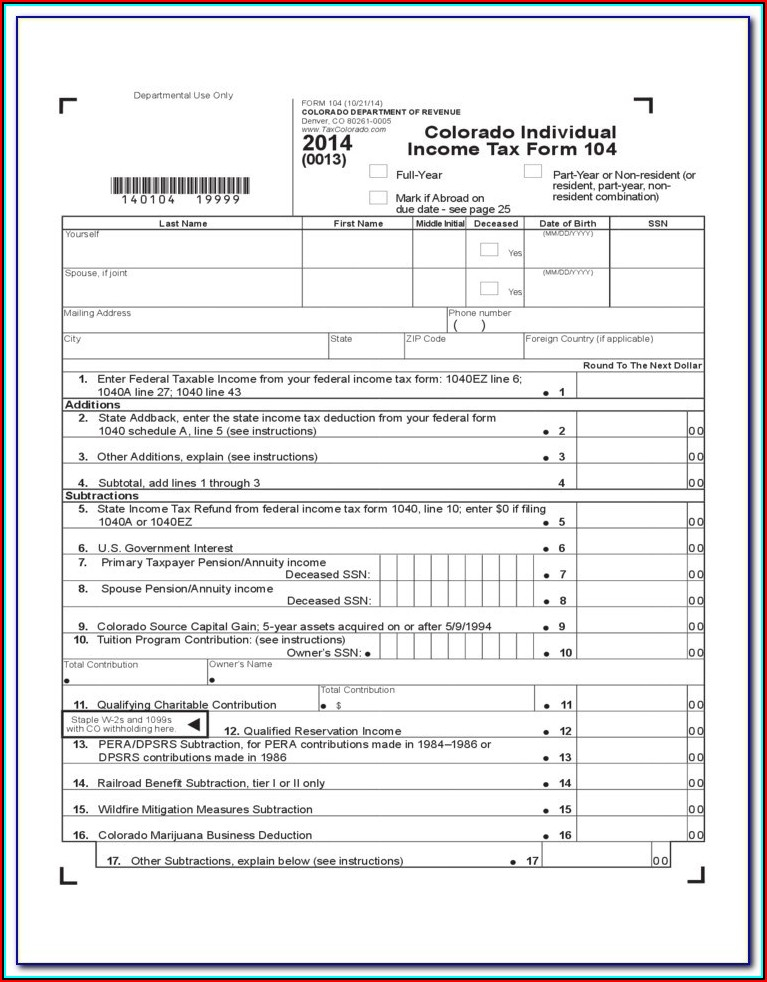

Before starting your tax return, gather all relevant documents, including W-2 forms, 1099 forms, receipts for deductible expenses, and any correspondence from the New York State Department of Taxation and Finance.

Choosing a Filing Method

You can file your NYS income tax return electronically or by mail. E-filing offers faster processing times and error-checking features, while paper filing may be preferred by those who require additional time or assistance.

Penalties for Late Filing and Payment

Failing to file or pay your NYS income tax on time can result in significant penalties and interest charges. Understanding these consequences can motivate you to stay compliant and avoid unnecessary expenses.

Failure to File Penalty

The failure-to-file penalty is 5% of the unpaid tax for each month or part of a month your return is late, up to a maximum of 25%. This penalty underscores the importance of meeting the April 15th filing deadline.

Failure to Pay Penalty

If you owe taxes but do not pay them by the deadline, you may incur a failure-to-pay penalty of 0.5% per month, up to 25% of the unpaid tax. Additionally, interest accrues on the unpaid balance at the federal short-term rate plus 2%.

Amending Tax Returns

Mistakes happen, and when they do, you can amend your NYS income tax return using Form IT-255. This form allows you to correct errors, claim additional credits or deductions, or report changes in your financial situation.

Steps to Amending a Return

- Complete Form IT-255 with the corrected information.

- Attach any supporting documents, such as W-2 forms or receipts.

- Mail the amended return to the appropriate address listed on the form.

Helpful Resources and Tools

Navigating NYS income tax can be challenging, but numerous resources and tools are available to assist you. These include online calculators, tax preparation software, and professional guidance from certified public accountants (CPAs) and tax attorneys.

Official Resources

The New York State Department of Taxation and Finance provides comprehensive information on its website, including tax forms, publications, and FAQs. Additionally, the IRS website offers valuable insights into federal tax laws that often intersect with state regulations.

Conclusion and Call to Action

In conclusion, understanding NYS income tax is essential for maintaining financial health and fulfilling legal obligations. By familiarizing yourself with filing statuses, tax rates, deductions, credits, and penalties, you can optimize your tax strategy and avoid costly mistakes. Remember to utilize available resources and tools to simplify the process.

We encourage you to take action by reviewing your tax situation, gathering necessary documents, and consulting with a tax professional if needed. Don't forget to share this article with others who may benefit from it and explore additional content on our website for more insights into personal finance and taxation.

For further reading, consider exploring related topics such as federal income tax, estate planning, and retirement savings strategies. Stay informed, stay compliant, and take control of your financial future!