When it comes to understanding property values, the role of a Davenport County Property Appraiser is crucial. Whether you're buying, selling, or managing real estate, knowing how properties are valued can significantly impact your financial decisions.

Property appraisal is not just about numbers; it's about ensuring fairness, transparency, and accuracy in the valuation process. A property appraiser in Davenport County plays a pivotal role in determining the market value of properties, which affects property taxes, loans, and overall market trends.

As we delve into this comprehensive guide, we'll explore everything you need to know about Davenport County property appraisers, including their responsibilities, the appraisal process, and how you can prepare for an appraisal. Let's get started!

Read also:Unveiling The Secrets Of Miaz Girthmaster A Comprehensive Guide

Table of Contents

- Biography of the Davenport County Property Appraiser

- Role of the Davenport County Property Appraiser

- The Property Appraisal Process

- How to Prepare for a Property Appraisal

- Impact of Market Trends on Appraisal

- Property Taxes and Appraisal

- Common Challenges in Property Appraisal

- Resources for Homeowners

- Technology in Property Appraisal

- Conclusion

Biography of the Davenport County Property Appraiser

In Davenport County, the property appraiser is a key figure responsible for assessing the value of all properties within the county. Below is a brief biography of the current Davenport County Property Appraiser:

| Name | John D. Smith |

|---|---|

| Position | Davenport County Property Appraiser |

| Years of Experience | 20 years |

| Education | M.S. in Real Estate Appraisal |

| Certifications | State-Certified Residential Appraiser |

Responsibilities of the Appraiser

John D. Smith's responsibilities include overseeing property assessments, ensuring compliance with state regulations, and maintaining accurate records of property values in Davenport County.

Role of the Davenport County Property Appraiser

The role of the Davenport County Property Appraiser extends beyond just determining property values. It involves:

- Conducting property inspections

- Managing property tax assessments

- Providing transparency in property valuation

Why the Role Matters

Property appraisers play a critical role in maintaining a fair and equitable tax system, ensuring that property owners are taxed fairly based on the actual value of their properties.

The Property Appraisal Process

Understanding the property appraisal process is essential for homeowners in Davenport County. Here's a breakdown of the steps involved:

Read also:Discover The Ultimate Movie Experience At Amc Loews Foothills 15

Step 1: Initial Inspection

During the initial inspection, the appraiser visits the property to assess its condition, size, and features.

Step 2: Market Analysis

The appraiser analyzes recent sales data of similar properties in the area to determine a fair market value.

Step 3: Final Report

After gathering all necessary data, the appraiser compiles a detailed report outlining the property's value and any factors that influenced the appraisal.

How to Prepare for a Property Appraisal

Preparing for a property appraisal can help ensure an accurate assessment. Here are some tips:

- Clean and declutter the property

- Highlight recent renovations or improvements

- Provide documentation of property upgrades

Common Mistakes to Avoid

Some homeowners make the mistake of not disclosing important information during the appraisal process. Always be transparent about any issues or changes in the property.

Impact of Market Trends on Appraisal

Market trends significantly influence property appraisals in Davenport County. Factors such as economic conditions, interest rates, and local development projects can impact property values.

Current Market Trends

As of 2023, the real estate market in Davenport County is experiencing a surge in demand, driven by low mortgage rates and increased migration to the area.

Property Taxes and Appraisal

Property taxes are directly linked to the appraised value of a property. A higher appraisal can lead to increased tax liabilities, while a lower appraisal may result in reduced taxes.

How Property Taxes Are Calculated

Property taxes are calculated by multiplying the appraised value of a property by the local tax rate. Homeowners can contest their appraisals if they believe the valuation is inaccurate.

Common Challenges in Property Appraisal

Despite the importance of property appraisals, several challenges can arise during the process. These include:

- Inaccurate data

- Market volatility

- Subjective opinions

Overcoming Challenges

Appraisers in Davenport County use advanced tools and technology to minimize errors and ensure accurate assessments.

Resources for Homeowners

Homeowners in Davenport County have access to various resources to help them understand property appraisals:

- Davenport County Property Appraiser's Office website

- Local real estate agencies

- State government publications

Why These Resources Matter

Access to accurate information empowers homeowners to make informed decisions about their properties and financial planning.

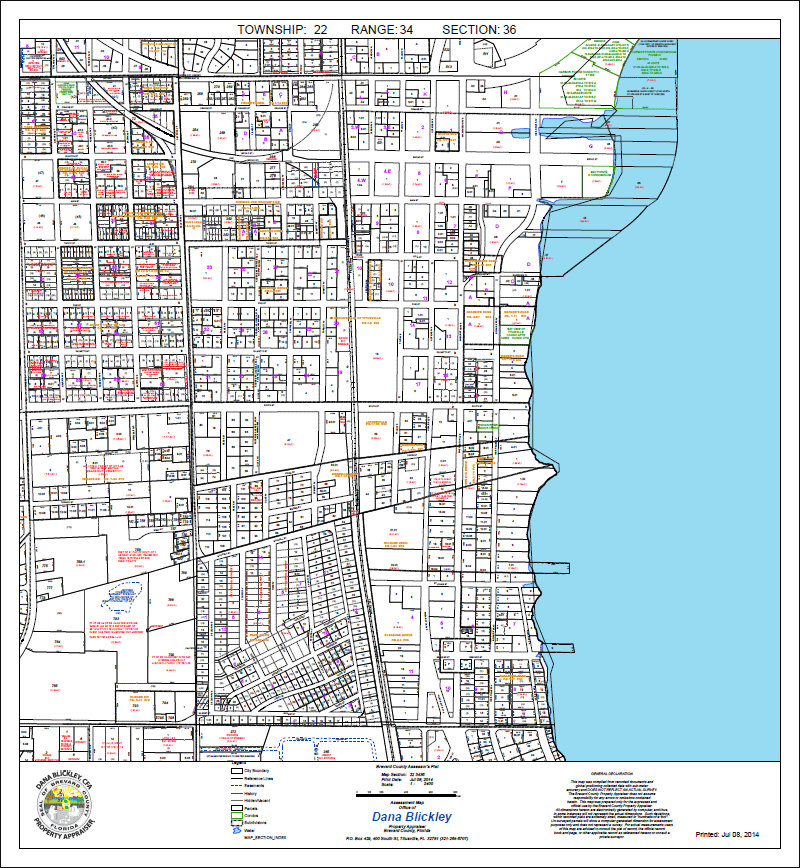

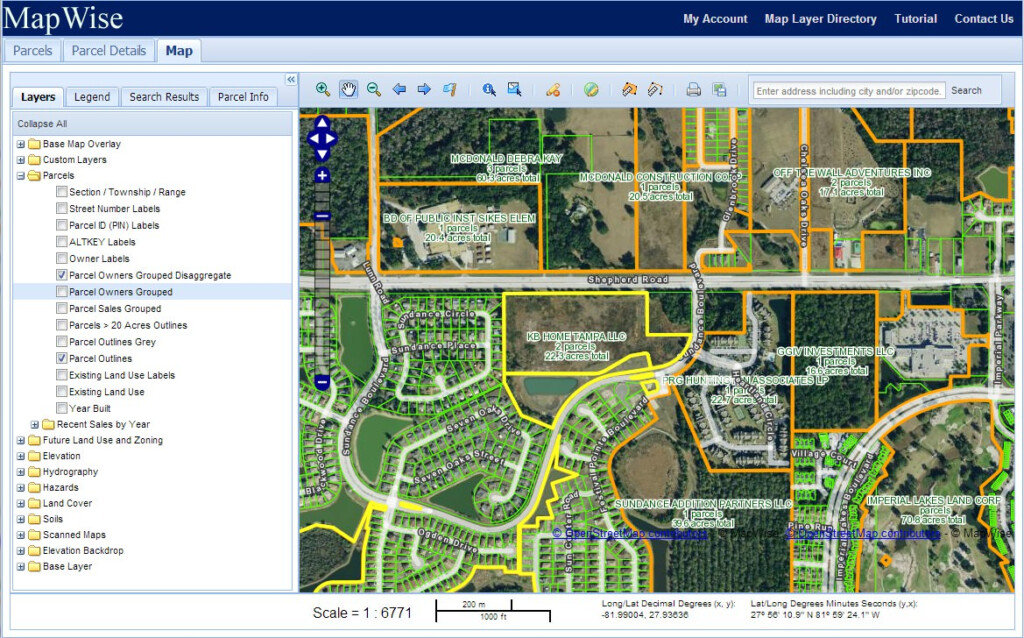

Technology in Property Appraisal

Technology plays a vital role in modern property appraisals. Tools such as Geographic Information Systems (GIS) and automated valuation models (AVMs) enhance the accuracy and efficiency of the appraisal process.

Benefits of Technology

Technology allows appraisers to analyze large datasets quickly, reducing the time and effort required for manual inspections.

Conclusion

In conclusion, the Davenport County Property Appraiser is a crucial resource for homeowners and real estate professionals. Understanding the appraisal process, preparing effectively, and utilizing available resources can help ensure fair and accurate property valuations.

We encourage you to take action by:

- Visiting the Davenport County Property Appraiser's website for more information

- Sharing this article with others who may find it helpful

- Leaving a comment or question below

Remember, staying informed about property appraisals can have a significant impact on your financial future. Thank you for reading!

References:

- U.S. Department of Housing and Urban Development

- Davenport County Property Appraiser's Office

- National Association of Realtors