When it comes to purchasing a car in Utah, securing the best auto loan rates can make a significant difference in your financial future. Whether you're buying your first car or upgrading to a newer model, understanding Utah's first auto loan rates is essential. In this article, we’ll break down everything you need to know about auto loans in Utah, including interest rates, financing options, and how to get the best deal.

Car ownership is a necessity for many Utah residents, but with the rising cost of vehicles, financing has become an integral part of the buying process. Knowing the ins and outs of auto loan rates can help you avoid unnecessary expenses and ensure you're making a financially sound decision.

From credit score considerations to negotiating tips, this guide will equip you with the knowledge you need to secure the best Utah first auto loan rates. Let’s dive in!

Read also:Kelly Lynch Unveiling Her Role In Charlies Angels And Beyond

Table of Contents

- Introduction to Utah Auto Loan Rates

- Key Factors Affecting Utah First Auto Loan Rates

- How Credit Score Impacts Loan Rates

- Types of Auto Loans in Utah

- Comparing Utah Auto Loan Rates

- Tips for Securing the Best Rates

- Using Loan Calculators to Plan Ahead

- Negotiating Your Loan Terms

- Common Mistakes to Avoid

- Future Trends in Utah Auto Loan Rates

Introduction to Utah Auto Loan Rates

Auto loans are a common financial tool used by Utah residents to purchase vehicles. Understanding Utah first auto loan rates is crucial, especially for first-time buyers. The state’s competitive market offers various financing options, but the rates can vary significantly based on several factors.

First-time buyers often face challenges when securing their initial auto loan. However, with the right knowledge and preparation, you can secure favorable terms that fit your budget. This section will explore the basics of auto loan rates in Utah and why they matter.

By familiarizing yourself with the loan process, you can make informed decisions that align with your financial goals. Whether you're purchasing a new or used car, understanding the rates will help you save money in the long run.

Key Factors Affecting Utah First Auto Loan Rates

1. Credit Score

Your credit score plays a pivotal role in determining the interest rates you qualify for. Lenders in Utah use your credit score to assess your creditworthiness. A higher credit score typically results in lower interest rates, while a lower score may lead to higher rates or less favorable terms.

2. Loan Term

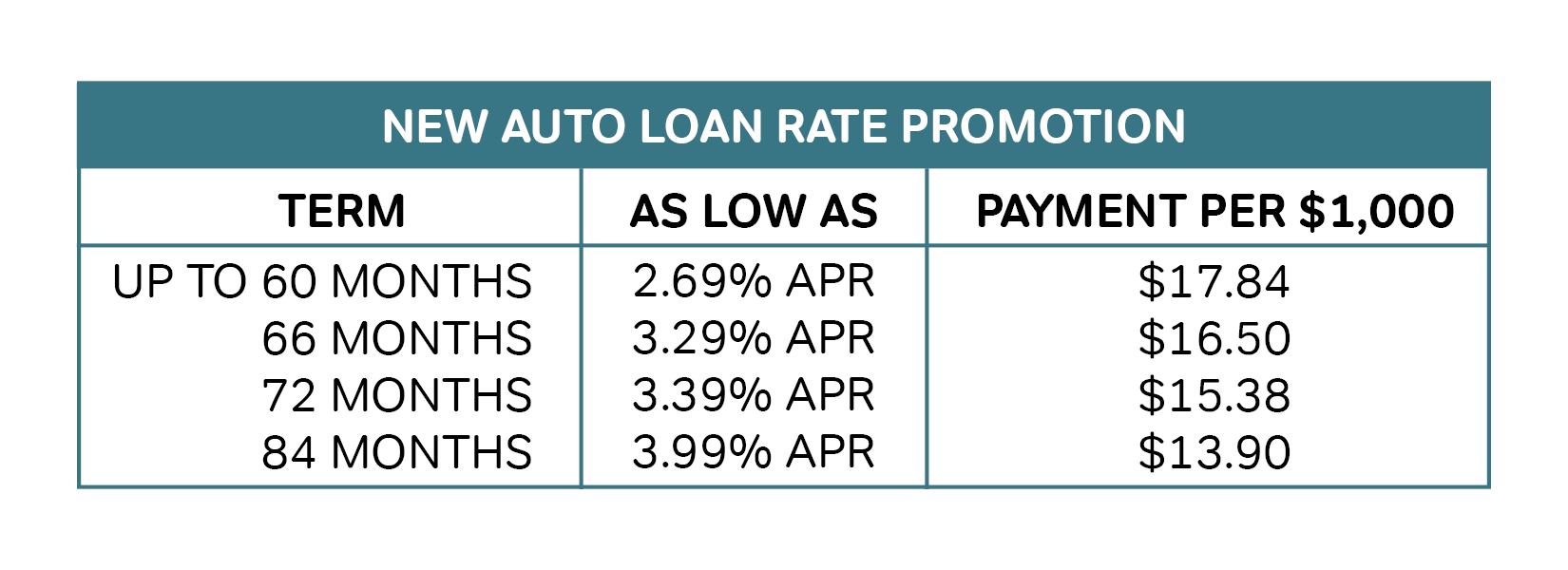

The length of your loan term also affects the interest rate. Shorter loan terms generally come with lower interest rates but higher monthly payments. Conversely, longer loan terms may have higher interest rates but lower monthly payments.

Choosing the right term depends on your financial situation and priorities. Consider both your budget and the total cost of the loan before making a decision.

Read also:Mastering The Basics Of V A Comprehensive Guide For Beginners And Experts

How Credit Score Impacts Loan Rates

Your credit score is one of the most significant factors influencing Utah first auto loan rates. Lenders use credit scores to evaluate risk, and borrowers with higher scores are often rewarded with better rates. Here are some key points to consider:

- A credit score of 700 or above is generally considered excellent and can lead to the best rates.

- Scores between 650 and 699 may still qualify for competitive rates but may not be as favorable as those with higher scores.

- Scores below 650 may result in higher interest rates or stricter loan terms.

Improving your credit score before applying for an auto loan can significantly impact the rates you qualify for. Paying bills on time, reducing debt, and maintaining a low credit utilization ratio are effective strategies for boosting your score.

Types of Auto Loans in Utah

1. New Car Loans

New car loans are designed for purchasing vehicles directly from dealerships. These loans often come with lower interest rates due to the higher value and longer lifespan of new cars. Additionally, manufacturers may offer promotional rates or incentives to encourage sales.

2. Used Car Loans

Used car loans are tailored for purchasing pre-owned vehicles. While these loans may have slightly higher interest rates, they often come with lower overall costs due to the reduced price of used cars. Many Utah lenders offer competitive rates for used car loans, making them an attractive option for budget-conscious buyers.

3. Refinancing Loans

Refinancing allows you to replace your existing auto loan with a new one that has better terms. This option is ideal for those who have improved their credit score or want to take advantage of lower interest rates in the market.

Comparing Utah Auto Loan Rates

Comparing loan rates is essential when shopping for an auto loan in Utah. Different lenders offer varying rates based on their policies and market conditions. Here are some tips for comparing rates effectively:

- Request quotes from multiple lenders to ensure you're getting the best deal.

- Consider both the interest rate and any additional fees associated with the loan.

- Read the fine print carefully to understand all terms and conditions.

By taking the time to compare rates, you can save thousands of dollars over the life of your loan. Use online resources and loan comparison tools to streamline the process.

Tips for Securing the Best Rates

Securing the best Utah first auto loan rates requires preparation and strategy. Here are some practical tips to help you get the most favorable terms:

- Improve Your Credit Score: Pay down debt, correct errors on your credit report, and maintain a low credit utilization ratio.

- Shop Around: Compare rates from multiple lenders, including banks, credit unions, and online lenders.

- Consider a Cosigner: If your credit score is low, a cosigner with a strong credit history can help you qualify for better rates.

Remember, the key to securing the best rates is preparation and knowledge. By doing your homework, you can negotiate confidently and secure a loan that meets your needs.

Using Loan Calculators to Plan Ahead

Loan calculators are valuable tools for planning your auto loan. They allow you to estimate monthly payments, total interest costs, and the overall cost of the loan. By inputting different variables such as loan amount, interest rate, and term length, you can see how each factor affects your financial situation.

Many online calculators are available for free and can provide instant results. Use these tools to compare different scenarios and make informed decisions about your financing options.

Negotiating Your Loan Terms

Negotiating your loan terms can lead to significant savings. Here are some strategies for negotiating effectively:

- Do Your Research: Know the market rates and be prepared to present competitive offers from other lenders.

- Be Confident: Approach negotiations with confidence and a clear understanding of what you want.

- Ask for Discounts: Don’t hesitate to ask for discounts or special promotions that may be available.

Remember, lenders want your business, and negotiating can often result in better terms. Be persistent and willing to walk away if the terms don’t meet your expectations.

Common Mistakes to Avoid

Avoiding common mistakes can help you secure the best Utah first auto loan rates. Here are some pitfalls to watch out for:

- Not Shopping Around: Failing to compare rates from multiple lenders can lead to missed opportunities for better terms.

- Ignoring Additional Fees: Be aware of origination fees, prepayment penalties, and other costs that can add to the total cost of the loan.

- Not Reading the Fine Print: Understand all terms and conditions before signing any loan agreement.

By avoiding these mistakes, you can ensure a smoother and more successful loan process.

Future Trends in Utah Auto Loan Rates

The auto loan industry is constantly evolving, and understanding future trends can help you make informed decisions. Here are some trends to watch in Utah:

- Increasing Interest Rates: As the economy grows, interest rates may rise, impacting loan rates.

- Technological Advancements: Online lending platforms are becoming more popular, offering faster and more convenient options for borrowers.

- Focus on Credit Scores: Lenders are increasingly emphasizing credit scores, making it more important than ever to maintain a healthy credit profile.

Staying informed about these trends can help you anticipate changes and adapt your financial strategy accordingly.

Conclusion

In conclusion, understanding Utah first auto loan rates is essential for anyone looking to purchase a vehicle in the state. By considering factors such as credit score, loan term, and type of loan, you can secure favorable terms that fit your budget. Remember to compare rates, negotiate confidently, and avoid common mistakes to ensure a successful loan process.

We encourage you to take action by exploring your financing options and using the tips and strategies outlined in this guide. Don’t forget to share this article with others who may find it helpful and explore more content on our site for additional insights into personal finance and auto loans.